Acquisition project | Leegality

About Leegality

Leegality is a document infrastructure platform that allows businesses to quickly deploy electronic signing, stamping, fraud-proofing, and automation across all their paperwork processes, in a fast, easy, and compliant way.

The major vision of leegality is to remove the paper from paperwork. We are industry and use-case agnostic, with a major presence across banks and financial service companies.

To understand Leegality, consider how a company executes an offer letter for one of its new employees.

The HR Team creates an offer letter, gets it signed by one of their managers, and sends the offer letter to the employee via email. The employee reads it, takes a printout, signs it, scans it, and sends it back to the employer.

It's such a hassle, isn't it?

That's where Leegality comes in. We help companies remove paper from their paperwork by digitalizing all legs of their paperwork journey. They can create documents on our platform, get them signed automatically by their authorized signatory, securely send the document to the employee, and let the employee sign the document on his smartphone, without the need to use a pen and paper.

And Leegality can do this for all kinds of paperwork, with a specialization in Loan Documentation.

Core Features

- BharatSign - Leegality provides more than 16 types of electronic signatures, all of which are legally valid and secure alternatives to physical signatures.

- BharatStamp - BharatStamp facilitates businesses to procure and affix legally compliant digital stamp papers hassle-free and is the only private stamping network that is fully compliant with Indian laws.

- Paperwork Operations - Leegality has digitalized all the legs of a document execution journey. We ensure that all the key steps such as document generation, document signing, digital stamping, sending, and storage can be done in one single platform.

- Low-Code APIs - Leegality also provides low-code APIs for each of our features so that our clients can integrate us with the platform of their liking such as Loan Origination and Management Systems, CRMs, ERPs, Document Management Systems, HRMS, and more.

How are we different from our Competitors?

We don't believe in comparison with our competitors. We believe in differentiation.

- We provide a deep solution to our clients. We are not just about digital signatures, which all of our major competitors are focused on. Our solution replicates each step of paperwork execution and we have expanded vertically to be the market leader in the industry.

- We are compliance-first. All of our features are first vetted based on compliance with Indian Laws so that our clients can execute their paperwork safely and securely and can legally protect themselves - a differentiation that stands out among our competitors.

- Our focus is to help our clients not just digitize but to help them reduce their turn-around time for paperwork, increase their workforce productivity, and hence, scale their business operations.

Understanding Leegality's Core Value Prop

For [businesses] that [need to execute a large number of documents],

[LEEGALITY] is an [document execution platform]

that [automates paperwork processes in a fast, easy, and compliant way]

Ideal Customer Profiles

ICP Name | Private Banks | NBFCs |

Job Title | Head of Department, Director | Regional Head, Deputy Manager |

Company Size | >10000 | 500-10000 |

Company Details | These mature banking companies have legacy IT systems and require compliant solutions to scale their businesses to the next level. The adoption of new solutions is slow and there is generally a lot of resistance from the internal teams. | These mid-size NBFC companies mostly function in Tier-3 and Tier-4 and their end-users can be from rural and semi-urban geographies. Their operations are quite complex and logistically expensive. |

Industry Domain | Private Banks | Financial Services |

Role in the Buying Process | High | High |

Reporting Structure | Report to CXOs | Report to MD |

Preferred Channels | Face To Face, Email, Video Call, Events | Face To Face, Email, Phone |

Type of Products used in workplace |

|

|

Major Use cases |

| Loan Agreements |

Pain Points |

|

|

Current Solution |

| Physical and Manual Paperwork |

General Behaviour |

|

|

Major Motivations |

|

|

Influencers | Digital Transformation Heads | Sales Managers |

Blocker |

|

|

ICP Prioritization

Parameter | ICP- Private Banks | ICP - NBFCs |

|---|---|---|

Adoption Curve | Low | Medium |

Frequency | Medium | High |

Appetite to Pay | High | Medium |

TAM | Medium | High |

Distribution Potential | Medium | High |

Core Insights

- Banks are more resistant to change than NBFCs because they are bigger organizations with legacy systems and have complex processes. NBFCs also don't have a high adoption curve but are still higher than banks.

- The frequency of use cases would be higher in NBFCs because they disburse more loans as compared to banks. While we have seen this through their use case via our internal data, it can be seen here as well.

- Banks have a higher appetite to pay as compared to NBFCs because they are bigger organizations with bigger budgets for digitization.

- TAM for NBFCs is way higher than Banks in terms of number of loans that they disburse. They lead the private banks by a huge margin.

- It's quicker to distribute our product to the Direct Selling Agents of NBFCs rather than the Banks. It's because banks are traditionally slower, have a slower adoption, take time to test out the product first with a smaller use case, and have fragmented management. This is not the case with NBFCs wherein the decision-makers have a power center and the distribution across the industry and inside the company as well, is quick.

Leegality, as a product, wins if the number of transactions increases. More transactions mean that more digital signatures will be used and hence, more revenue for Leegality.

Market Sizing

Leegality provides its products and services under the Digital Transaction Management category. We will use the top-down approach for market sizing for the overall market.

Total Addressable Market

As per this market research report, the TAM for the global digital transaction management market is $15B in 2024.

Leegality will go global sooner. Therefore, we will need to look at the international market.

Serviceable Available Market

Given the above numbers, we have got an idea of what the global market looks like. Let's dive further into calculating the SAM.

As per the product and the market, the SAM can be filtered out using the following parameters:

- Geography - India

- Market Segment - Electronic Signature

In the above report, the electronic signature and workflow automation segment market is worth 35% i.e. around $5.25B.

Let's assume that the percentage of the market share in India is 10% of the global market share.

SAM = Market share of Global Target Segment x Percentage of Market share in India = $5.25B x 10% = $525M

Serviceable Obtainable Market

Assuming we wish to capture 30% of the market because that would make us the market leader in the segment:

SOM = SAM * Target Market Share = $525M * 30% = $157M

Insights from Market Sizing

Level | Overall Market Size |

|---|---|

TAM | $15 Billion |

SAM | $900 Million |

SOM | $157 Million |

Leegality's major competitors in the above market:

Competitor Name | Revenue | How is Leegality Different | Estimated Market Share |

|---|---|---|---|

SignDesk | 175 Cr | Signdesk is the closest competitor of Leeglaity. While they are generating higher revenue and their pricing is competitive, Leegality seems to be a more compliant solution, in terms of one of the core features i.e. Digital Stamping. | 13% |

Digio | 70 Cr | Digio has done one thing well and that is to build a compliant SaaS Solution for Stockbrokers. However, besides that they are not as prevalent in the wider market as Leegality. They also lag in terms of capability. | 5.3% |

eMudhra | 100 Cr | Digital Transaction Management is not eMudhra's major business. Their major business comes from selling DSC Tokens, which is not as scalable as a SaaS Business and is in the hardware segment. | 7.6% |

In 2023-24, Leegality touched almost 100 Cr.

Given that the SOM in 2024 is around $157 Million i.e. around 1312 Cr. It seems correct, given that, Leegality's Revenue and the revenue of its competitors is around 445 Cr.

The remaining market share is owned either by standalone smaller players or by global players such as Docusign, Zoho Sign, and Panda Doc.

Therefore, Leegality's current market share comes around to 7.6%, which makes Leegality the second largest player in the segment

Acquisition Channels

Currently, the Acquisition Channels that Leegality uses are:

Channel name | Cost | Flexibility | Effort | Lead Time | Scale |

|---|---|---|---|---|---|

Outbound - Email + Calls | Medium | Low | Medium | Low | Low |

Inbound - Email Marketing | Low | High | Low | High | Low |

Paid - LinkedIn Ads | High | High | Low | Low | High |

SEO | Low | Medium | Medium | High | High |

Events | Medium | Low | Medium | Low | Low |

Product Integration | Medium | Low | High | Low | High |

Partner Program | Low | High | Low | Medium | High |

Referral (Partner + Client) | Low | Medium | Low | Medium | High |

Insights on Existing Acquisition Channels (Data from 2020-2024)

✅ Outbound is the most successful channel with the highest revenue at 33% of the total revenue generated. It also has the highest average revenue per successful deal and has helped us generate the highest number of leads.

✅ Client/Prospect referral is the second most successful channel, generating 30% of the total revenue, followed by Partner Referrals at 12%.

✅ Inbound channel (mostly email marketing) generated the highest number of leads and helped us generate the fourth highest revenue but the average revenue per deal was low.

✅ Events has been the least impactful channel, with the lowest number of deals followed by LinkedIn Ads (Paid Advertising).

Outbound, Client Referral, and Partner Referral generated 75% of our total revenue while Paid Advertising and Events generated less than 1% of our revenue.

Main Channels | Experimental Channels |

|---|---|

Outbound | Organic |

Prospect/Client Referral | Paid Advertising (LinkedIn) |

Partner Referral | |

Optimizing our Main Channels

Outbound

While the Outbound channel is our most successful channel, it's working as a well-oiled machine with consistent optimizations. As it is process-heavy, we may not have high-impact, low-effort optimization that can be done.

Prospect/Client Referral

Existing Process:

- While prospecting (via any channel), the BDR team may come across certain prospects who may not need our solution or might not go ahead with us due to certain, but they would happily refer us to someone in their organization in another vertical or department, in this case, it becomes a Prospect Referral.

- Another scenario can be an employee of an organization that already uses Leegality, moving to another organization and then referring us to their new organization. Or there can be a scenario where an existing client may refer us to other departments in their company.

Problems Identified:

This method is not very organized. This is something where the process just goes through wherein the BDR may come across a lead, follow it, get a referral and the deal moves to the next stage. There's hardly anything that can be done here because SOPs are already in place. However, we can optimize a little bit for the referrals.

So, the process looks like this:

Reach out to a Lead >> Lead asks us to share an email >> We send an email which is forwarded to the the person getting referred >> We get a call back

Hypothesis:

- If we are able to track the number of opens or forwards on a particular emails that are being sent to the prospect, we may be able to understand which kind of prospects are actively referring us. This can either be done via an in-house referral portal, which will be expensive. Or we can use a tool like Mailsuite to track the number of emails opened.

- If we attach a link to the resource in that email, which can be a pitch deck, we may be able to track who and when the pitch was accessed. We are already using a tool for that, GTMBuddy.

Action Items:

- Implement Mailsuite to track emails.

- Use GTMBuddy to track who and how many people opened our document

Partner Referral

Existing Process:

- We have a dedicated partnerships team that builds and sustains partnership relationships with other companies that have complementary products to ours. For example, a bank uses a Loan Management System to manage their loans. Therefore, our partnerships team builds business partnerships with such businesses that have loan management systems as their product.

- It has 2 models:

Model | Referral | Reseller |

|---|---|---|

About | Partner refers us to one of their clients in exchange for a percentage of a one-time fixed commission. They bring us deals. | Partner white labels and integrates us in their solution in exchange for a percentage of commission on each transaction. They bring us transactions. |

Type of Business | SaaS | Tech Enablers |

Revenue Share | Lower | Higher |

Why does this model work? |

|

|

Problems |

|

|

Problems Identified:

Both models have certain problems due to their nature rather than something we always optimize for. However, one thing that can done is to productize our referral process.

Hypothesis:

- Productizing the referral process can help our partners automate the process and it can help us track and manager our referrals productively.

- Productizing may work for both models.

Action Items:

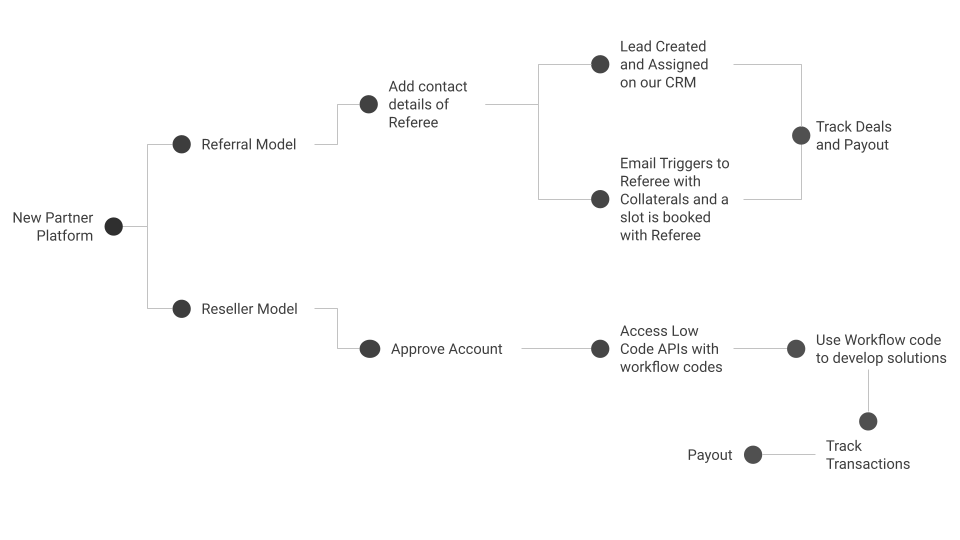

- Productize the Referral Process, which may look like this:

Other Channel Experiments (For all ICPs)

Paid

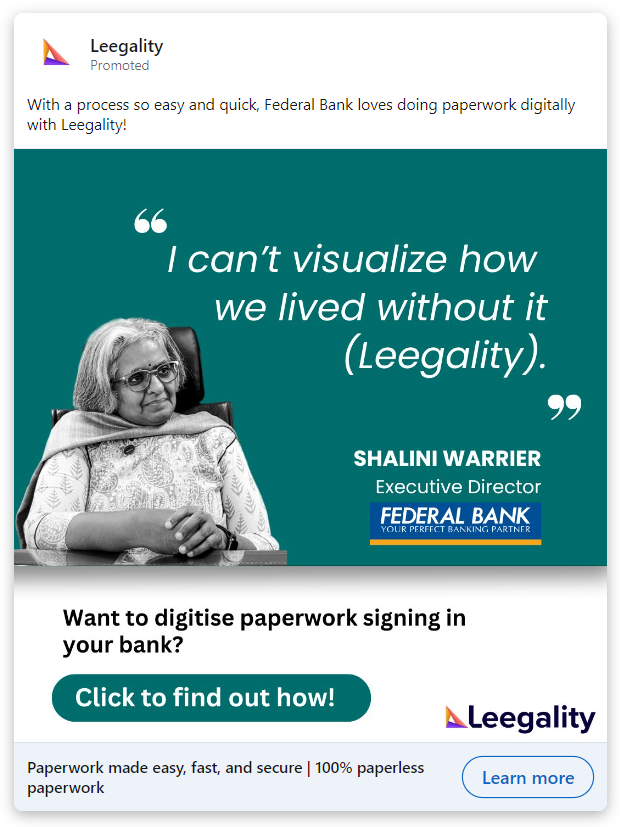

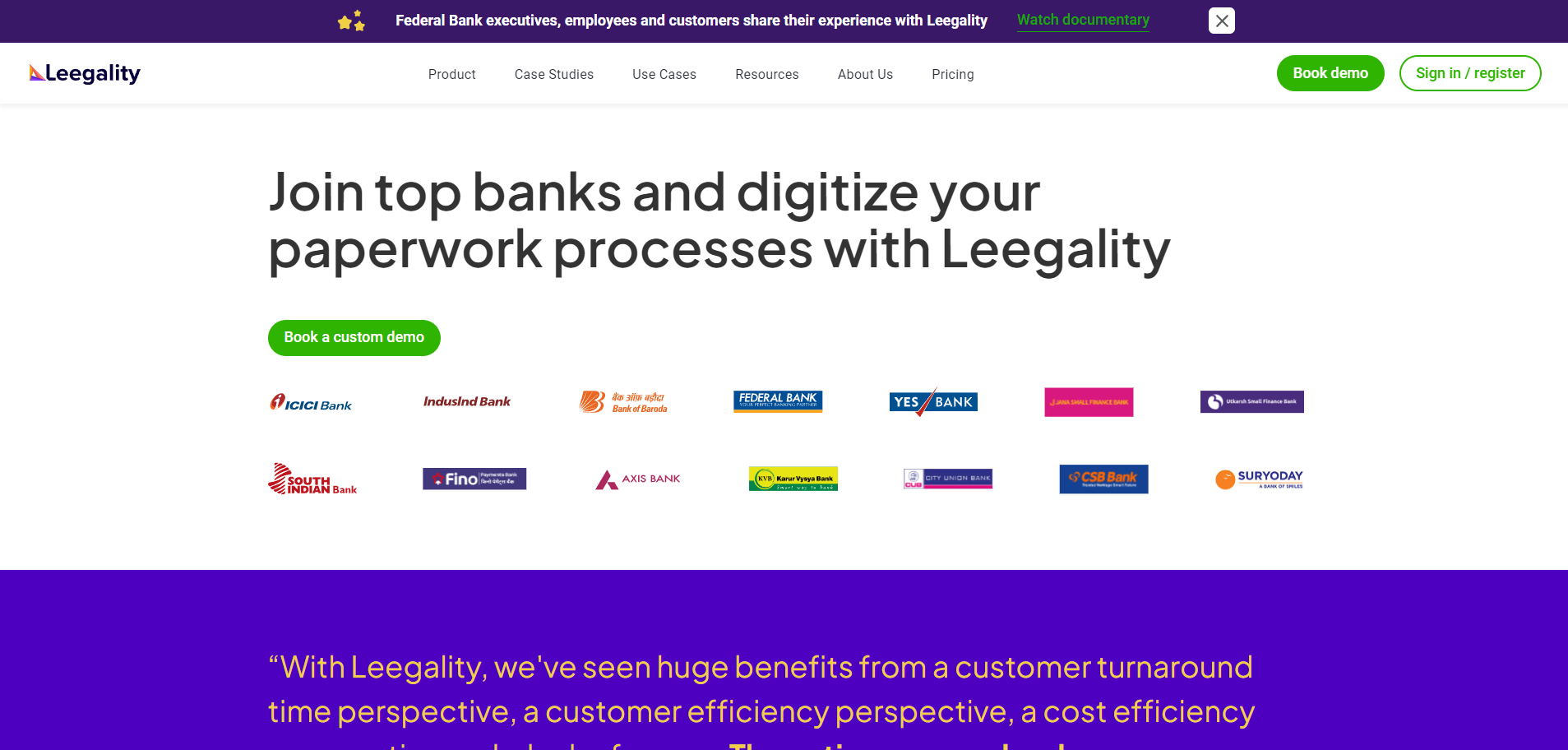

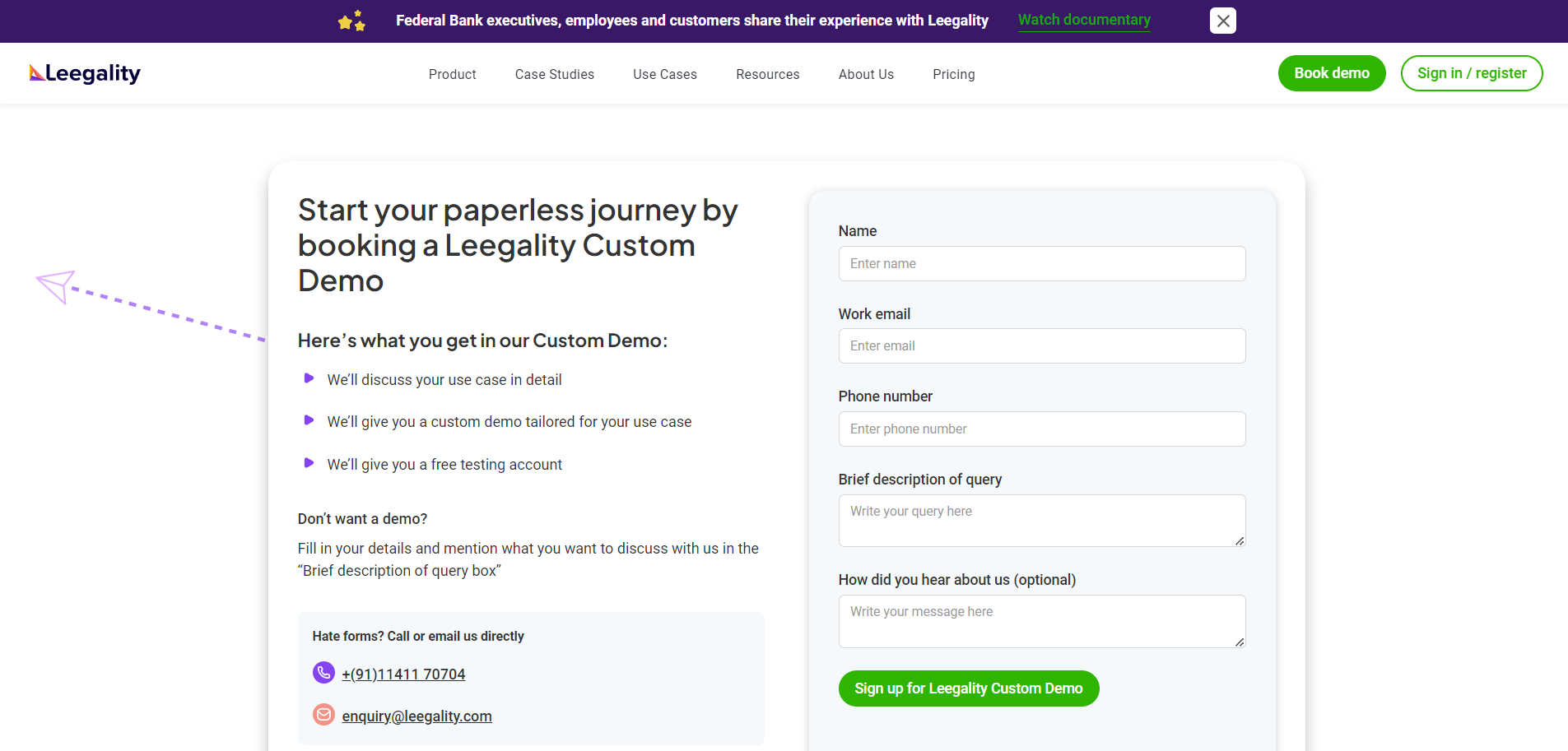

This is what the flow of one of our LinkedIn Ads currently looks like:

Step 1:

Step 2:

Step 3:

Problems Identified:

As we can see from the screenshots above, it takes a lead 3 steps to book a demo with Leegality.

Hypothesis:

- Reduce the number of steps from 3 to only 1 to book a demo with us.

- More lead generation due to reduced drop-offs.

- Better brand looks across LinkedIn.

Action Items:

- Use LinkedIn Lead Gen Forms for all the ads.

- Keep the branding colors and font consistent across ads.

Organic

Problems Identified:

We need a better brand footprint online. If you look at Leegality's presence on various software comparison websites, it's almost negligible. We need to improve it

Hypothesis:

- Consistent Brand Presence on these websites builds brand recall.

- Getting more reviews on these platforms builds credibility.

- Being active on these platforms can bring in Inbound leads via Google Search and comparison search.

- Launching Leegality on Product Hunt can bring visibility from founders and decision-makers, thus increasing the inbound potential.

Action Items:

- Customize the brand look across platforms by updating the brand look (logo, colors, screenshots), brand voice (written content), and brand behavior.

- Launch the product on ProductHunt as it has not been launched there yet.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.